How Wire Transfers Work: Sending and Receiving Funds

Sending or receiving money quickly is not a problem anymore, as wire transfers are the right tool for the job. They are fast, reliable, and generally safe.

What is a Wire Transfer?

A wire transfer is referred to as an electronic transfer that facilitates sending and receiving a large amount of money quickly and safely. Usually, when someone is talking about a “bank wire”, they mean traditional, local bank to bank transfer. With a bank wire, money is sent from one bank to another using a network such as SWIFT or Fedwire.

However, a wire transfer is different and applies to international transfers. Using a wire transfer, people located in different geographical regions can safely transfer funds to locales and financial institutions around the world.

How Do Wire Transfer Works: Sending and Receiving Funds

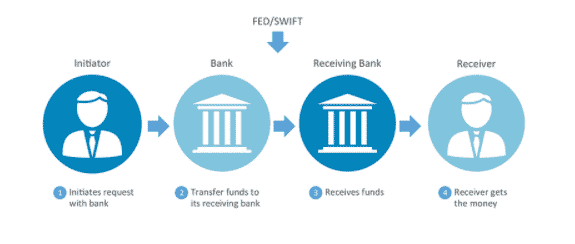

Most commonly, a wire transfer is used to transfer money from one bank or financial entity to another. With wire transfers, no physical money is involved while transferring between banks or financial institutions. Instead, information related to the recipient such as account number, the amount transferred, etc. is shared between the institutions.

The sender involved in the wire transfer pays for the transaction in advance to their bank. The sender’s bank then sends a message to the recipient’s bank with instructions related to payments. This is done through a secure network such as SWIFT or Fedwire.

The recipient’s bank receives all the information from the sender’s bank and deposits the amount in their own reserve funds. Both the sender and receiver bank then settle for the payment on the back end after the money has already been deposited.

Other than bank wire transfers, there are also non-bank wire transfers such as Western Union. Non-bank wire transfers do not require the bank account numbers of the receivers.

Other than bank wire transfers, there are also non-bank wire transfers such as Western Union. Non-bank wire transfers do not require the bank account numbers of the receivers.

Speed

Wire transfers are extremely useful as they are quick, and normally they will only take a few days to transfer the money depending on the location. A domestic wire transfer is processed within a day, whereas international transfers normally require two working days to complete the process.

The reason why domestic and international transfers have different lead times. This is due to the use of domestic Automated Clearing Houses (ACH) and foreign processing systems. Domestic transfers only require going through ACH, but international wire transfers first need to clear ACH and then its foreign equivalent, thus, it adds an additional day to the processing.

Clearance

With a wire transfer, money moves quickly, so the recipient does not have to wait for several days for their funds to clear. This is because there is no bank hold placed on money received via wire. But it may take several hours for the receiver’s bank to show the wire transfer in the recipient’s account – even if the money has been received. It is because bank employees are required to complete a few formalities to make the funds available in the account.

Cost

To initiate a wire transfer, it requires a fee regardless of its type. The charges depend on the providers as some domestic transfers cost $25 per transaction but can exceed $35 or more. International wire transfers can cost as much as $45.

How Safe Are Wire Transfers?

Generally, wire transfers are safe and secure if you know the receiver. With a legitimate wire transfer, the identities of each party involved are carefully vetted so that anonymous transfers cannot be possible. Also, there are agencies such as in the United States where international transfers are monitored by the Office of Foreign Asset Control, who ensure that money sent abroad is not being used for illegal activities or money laundering.

Learn more >> 5 reasons to learn more about Financial Markets