How to effectively dispute a credit card chargeback?

Understanding the Chargeback Process

Before delving into the nuances of disputing a credit card transaction, it’s crucial to grasp the concept of a chargeback.

Defining Chargeback

A chargeback shields cardholders from potential financial losses stemming from fraudulent charges, unauthorized transactions, or unsatisfactory purchases. Essentially, it offers an avenue for customers to dispute questionable transactions reflected on their statements.

When you raise a dispute, the card issuer or bank probes and determines the claim’s legitimacy. Concurrently, the merchant from whom the transaction originated is tasked with furnishing sufficient evidence to validate the transaction’s authenticity. If the merchant fails to provide convincing proof, the bank might consider the transaction illegitimate. Consequently, the disputed sum, often accompanied by a supplementary fee, is retracted from the merchant’s account and reimbursed to the customer.

Want to know more about chargeback? Read here

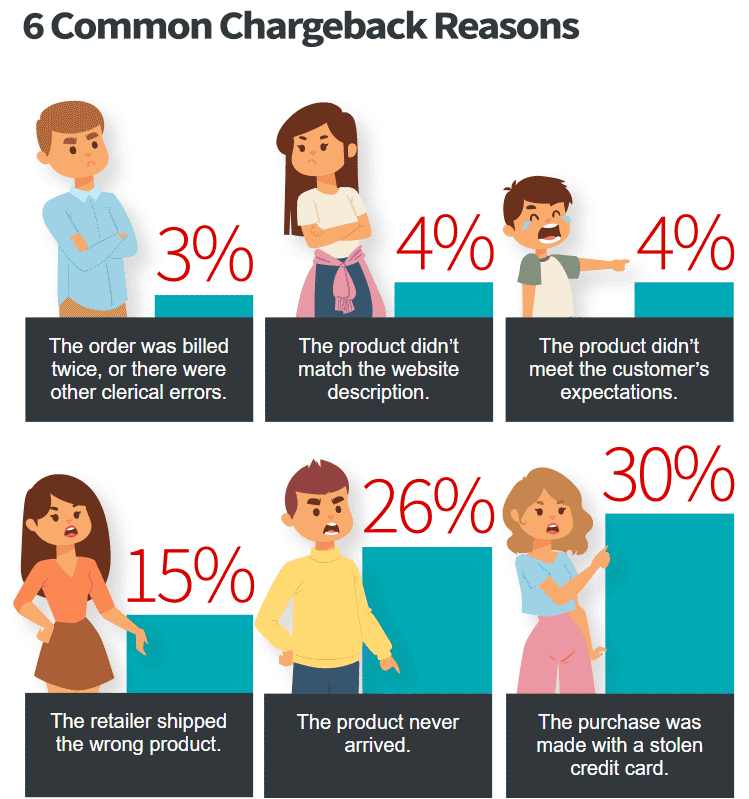

Common Reasons to Dispute a Credit Card Chargeback

Credit card disputes arise for various reasons, with cardholders seeking chargebacks to address these discrepancies. Below are some of the prevalent grounds for initiating a chargeback:

1. Unauthorized Charges:

A significant portion of credit card disputes stems from unauthorized use, including stolen cards, identity theft, and fraudulent transactions. Neither the cardholder nor the bank is accountable for such illicit activities. Immediate notification to the card issuer is vital if your card is lost, stolen, or if you spot an unauthorized transaction. In some instances, unauthorized charges may materialize even if the card is physically with you—this typically arises when malefactors obtain your card details illicitly. These charges can be disputed.

2. Billing Errors:

Billing discrepancies are another leading cause of disputes. For instance, you might be billed for a transaction you didn’t authorize, or perhaps you’re charged twice for a single purchase. Whenever such errors manifest, the initial step should be to seek redress from the merchant. If this approach doesn’t yield satisfactory results, disputing the chargeback becomes a viable alternative.

3. Gray Charges:

Certain charges might appear on your statement unbeknownst to you, often termed as “gray charges.” These arise from clauses embedded in the Terms and Conditions of a purchase—like auto-renewals or subscriptions—that a customer might inadvertently agree to. A lack of clear communication from merchants about these charges often leads to disputes.

4. Issues with Purchases or Returns:

Occasionally, products or services ordered might fail to align with their descriptions or meet expectations. In some scenarios, the ordered items aren’t delivered or turn out to be defective. While the primary recourse is to engage the seller or merchant, you can escalate unresolved grievances through a chargeback.

For instance, during the early stages of the COVID-19 pandemic, many travelers found out that canceling a flight booking wasn’t easy. As a result, numerous airlines resisted refunds. However, for those who had used credit cards, a chargeback dispute became an option.

It’s pivotal to underscore that while the stakes might be relatively low for minor sums, disputes involving heftier amounts necessitate meticulous handling. The potential loss magnifies in cases involving substantial sums. Engaging experts adept at navigating the intricate terrain of chargebacks becomes indispensable in such scenarios.

How to Dispute a Credit Card Transaction

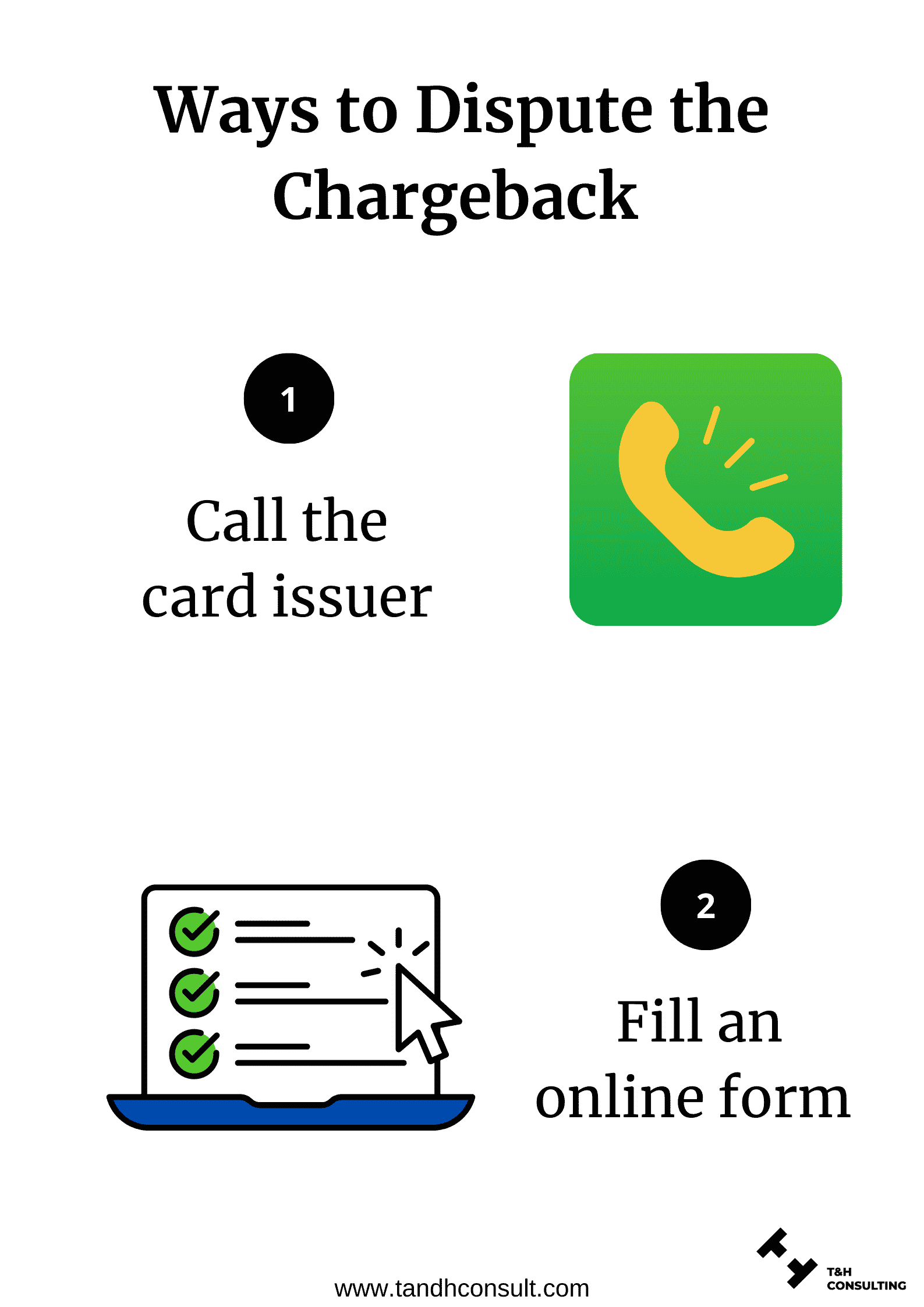

As a cardholder, you can dispute a credit card transaction in two ways, but the process may vary depending on the credit card company:

- Call the card issuer and explain the reason for disputing a chargeback. A representative will ask for your necessary details to file the dispute.

- Dispute the charge using your online credit card account by filling a form mentioning why you are disputing the chargeback.

Key Chargeback Dispute Tips

Navigating the chargeback process can be intricate. Here are some salient tips to ensure you approach it adeptly:

1. Regular Monitoring: Firstly, always scrutinize your credit card statements meticulously to identify any billing anomalies or unsanctioned transactions.

2. Establish Authenticity: Secondly, before initiating a chargeback, ascertain the veracity of the transaction. It’s conceivable that a family member executed the transaction without your cognizance.

3. Accumulate Evidence: Compile a comprehensive dossier of all pertinent details related to the merchant or dubious entity—this includes names, email addresses, phone records, messages, and any other relevant correspondences. This evidence bolsters your chargeback claim.

4. Timeliness is Key: Ensure you report unauthorized charges promptly—ideally within 60 days from your statement’s closure.

5. Initiate with the Merchant: For disputes stemming from card-based transactions, always commence by engaging with the merchant to rectify the situation.

6. Directly Alert the Issuer: You can report spurious charges directly to your card issuer. Notably, cardholders are typically not accountable for charges exceeding $50. However, this liability is nullified if the report is submitted within two billing cycles.

7. Be Aware of Resolution Timelines: On average, dispute resolution spans 60-90 days, contingent on the card issuer’s protocols. Consequently, it’s pivotal to act swiftly.

8. Seek Expertise: Engage specialists like T&H Consulting for adept guidance. Given that you generally have a singular opportunity to dispute a transaction, leveraging expert insights can expedite the process without being financially burdensome.

9. Employ Chargebacks Judiciously: The chargeback facility is a significant safeguard for cardholders. It’s imperative to utilize it responsibly, ensuring your claims are substantiated with cogent evidence.

Final Thought

T&H Consulting boasts a cadre of seasoned professionals adept at navigating the multifaceted chargeback landscape. If you’re grappling with a convoluted dispute, reach out to us for a complimentary 15-minute consultation to chart the best course forward.